Nov 7, 2024

Will your future Rivian R1S become a collector’s item sooner than you think?

At $5.4 billion, increasing competition from Kia’s EV9, and doubted by Tesla’s Elon Musk, Rivian’s future looks uncertain. As the fifth-largest EV maker in America enters its make-or-break year, several questions arise. Is it possible for Rivian to achieve its ‘Bridge to Profitability’ strategy? Far from increasing, cash reserves have been cut in half to $7 billion from 2021.

Now let us analyze Rivian’s current position to better understand what lies in its future as an EV maker.

Brief Background

Electric car maker Rivian, which was founded in 2009, has grown from a dream into the fifth-largest electric vehicle maker in America. Founded in 2009, the manufacturer has already released two more upscale vehicles - the R1T pickup and R1S SUV. These vehicles could be considered as one of the key players in the rapidly growing market of luxury electric cars. The fast pace at which the company has grown suggests both the market want and the company's know-how to successfully introduce new products into the market.

Current State of Affairs

Rivian noted outstanding growth and became one of the five biggest EV manufacturers in the United States but a $5.4 billion net loss in the 2023 report. This divergence between market success and financial success brings into question the sustainability of the firm.

Signs of Concern

There are several key issues that Rivian will encounter in 2024. Its cash position has reduced from $14 billion to $7 billion since 2021, implying roughly two years of operating headroom at current expense. Increased production estimates have been made less optimistic with expected annual output for 2024 cut by 20,000 to 60,000 vehicles.

Competition in the market is stiffer today than it was in the past. With the launch of the Kia EV9 at $44,400 below Rivian R1S, the firm faces direct rivals within the electric three-row SUV market. Further, high interest rates, close to 6%, become a massive hurdle for Rivian’s high-end vehicles starting from $75,000 to $99,000.

Signs of Hope

To overcome these challenges, Rivian has formulated the following strategic plan. The financial sustainability strategy – the “Bridge to Profitability” headed by the company’s CFO Claire McDonough is logically divided into stages. Sustained cost management with measures such as a 10% reduction in staff and manufacturing process efficiencies are expected to contribute 80% of the needed savings for profit-making.

The new R2 platform launched on March 7 is a clear shift of focus toward market-oriented activities. The expected pricing of this new product line ranges from $45000 to $55000 and is aimed at a wider market. Moreover, the commercial vehicle demand is secured by the partnership with Amazon which is a 17% stakeholder.

Critical Success Factors for 2024

To achieve the goals, the R2 launch must meet two key aspects that were set in terms of price and the efficiency of production. The company has to execute its declared cost-saving measures as well as sustain the quality of the products. Above all, Rivian needs to show that it is on the way to positive operational cash flows, based on higher production economies and stable consumer demand.

Expert Perspectives

There are still opposing opinions among various industry specialists. Tesla CEO Elon Musk said they could face “~6 quarters” of insolvency if no changes are made, but also mentioned Rivian’s product strength. The estimates of bankruptcy probabilities according to Wall Street range from 35% to 53%. Nonetheless, some analysts compare it to Tesla’s early days, arguing that Rivian might be on the path to turning a profit.

Potential Outcomes

Three primary scenarios emerge for Rivian's future:

1. Independent Success: Evaluating the “Bridge to Profitability” plan that must be successfully implemented and rather high R2 sales ensure sustainable business.

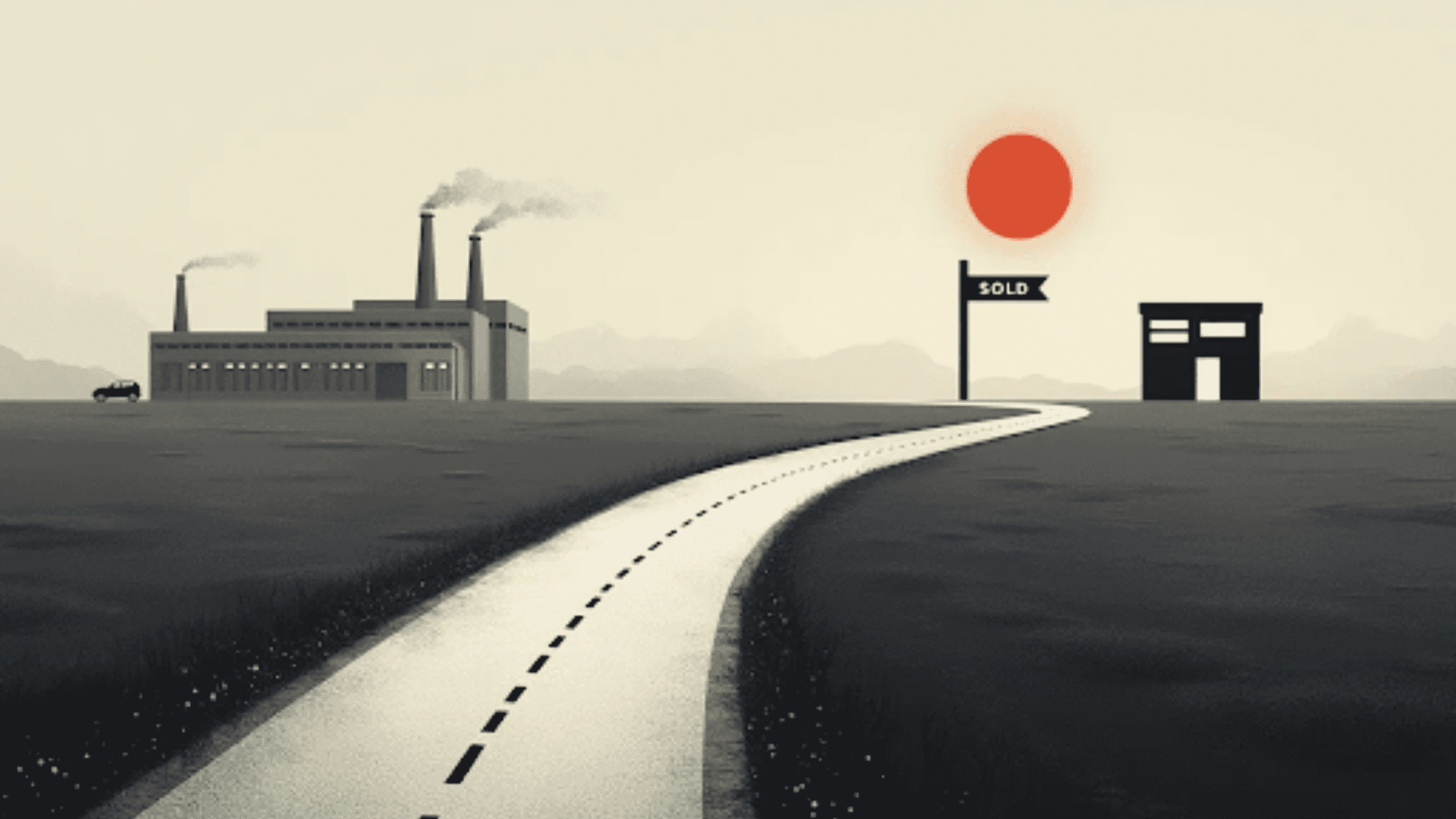

2. Strategic Acquisition: A more prominent automotive or technology firm buys Rivian for its technology and positioning.

3. Market Exit: Sooner or later, the company starts experiencing further losses and market pressures that lead to restructuring or bankruptcy.

Conclusion

Rivian is at a significant point of decision in the year 2024. The organization’s strategies, a solid portfolio of products, and the partnership with Amazon define clear avenues for its survival despite many obstacles. Much depends on the R2 launch and the company’s ability to improve production economies. But for investors and consumers, the upcoming quarters will show if Rivian has the potential to turn into a solid automotive company.